The Union Budget 2025, presented by Finance Minister Nirmala Sitharaman, has introduced significant reforms aimed at strengthening the Indian economy. With a strong focus on fiscal discipline, infrastructure growth, and tax relief for the middle class, this budget sets the tone for India’s economic trajectory in the coming years. Here’s a detailed breakdown of the most searched aspects of the 2025 budget.

Income Tax Reforms 2025: Relief for Middle-Class Taxpayers

One of the biggest highlights of the budget is the revised income tax reforms 2025. The government has increased the income tax exemption limit from ₹8 lakh to ₹12 lakh under the new tax regime. This move is expected to benefit millions of salaried individuals, increasing disposable income and boosting consumer spending. Additionally, deductions on investments in retirement savings and insurance have been extended, providing further relief to taxpayers.

Fiscal Deficit Reduction: A Step Toward Economic Stability

The government has announced an ambitious plan to reduce the fiscal deficit to 4.4% of GDP. This move aims to enhance economic stability by controlling public borrowing and maintaining investor confidence. By keeping fiscal deficit in check, the government ensures that inflation remains controlled while supporting economic expansion.

GDP Growth Projections: A Positive Outlook

The Indian economy is projected to grow at a rate of 6.3% to 6.8% in 2025, positioning India among the fastest-growing economies globally. The budget outlines several measures to drive this growth, including increased capital spending, ease of doing business reforms, and a push for domestic manufacturing under the ‘Make in India’ initiative.

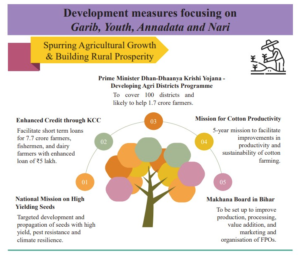

Boost to Agricultural Initiatives

The government has placed significant emphasis on agricultural initiatives, launching the Prime Minister Dhan-Dhaanya Krishi Yojana. This initiative aims to support 17 million farmers through subsidies and access to better technology. Additionally, the establishment of the Makhana Board in Bihar has been announced, aiming to boost the local economy and provide employment opportunities.

Infrastructure Development: Strengthening Core Sectors

A record allocation has been made for infrastructure development, focusing on roadways, railways, and smart city projects. The government’s continued emphasis on capital expenditure is expected to attract private sector investments, creating jobs and improving urban development.

Energy Transition Goals: Towards a Greener Future

To achieve long-term sustainability, the budget has laid out a clear roadmap to transition towards clean energy. The goal is to generate 100 GW of nuclear energy by 2047, along with increased investments in solar and wind power projects. This aligns with India’s commitment to reducing carbon emissions and promoting green energy initiatives.

Support for MSMEs and Digitalization

The budget provides much-needed relief to Micro, Small, and Medium Enterprises (MSMEs) through tax benefits and easier access to credit. Digital transformation has also been prioritized, with the government announcing incentives for businesses adopting AI-driven solutions and automation.

Conclusion

The India Budget 2025 is a balanced approach toward economic growth, fiscal stability, and sustainability. With tax relief for the middle class, strong investments in infrastructure development, and a focus on energy transition goals, this budget aims to lay a strong foundation for India’s future. As businesses and individuals navigate these changes, the emphasis on GDP growth projections and fiscal deficit reduction will play a crucial role in shaping the economy.

For more information please visit Flip The Web today.